Table of Content

No matter what large expenses you may face in the future, a home equity line of credit from Bank of America could help you achieve your life priorities. You’ll continue to pay principal and interest on what you borrowed. You have the flexibility to decide when and how much to use through Online Banking, by phone, at our financial centers or with no-access-fee checks.

Bank of America, which is owned by Bank of America Corporation, is one of the biggest banks and financial services companies in the United States. Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer. We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy.

Bank of America Life Insurance

Bank of America has credit lines for businesses worth between $10,000 and $100,000. You are eligible if you have been in business for at least two years and made at least $100,000 in sales last year. They are a good way to pay off other loans or pay for home improvements because of this. When you sign the contract, you’ll know both the interest rate for today and the interest rate for thirty years from now. Go to Bank of America Login to set up and access your online bank account. We can help you set up an online bank account and securely log into your Bank of America account.

And we’re local, which means we are flexible and accessible. We’ll sit down and talk through your best-fit option — and take you from application to closing. During the loan application process they lost then deleted my personal financial documents. Emergency costs including medical bills and other unforeseen expenses, and education tuition and fees.

Make your HELOC more affordable with these generous discountsfootnote4

Bankrate expert Garrett Yarbrough strives to make navigating credit cards and credit building smooth sailing for his readers. In the United States, credit cards are one of the most common ways to borrow money. The lender gives you a credit limit, which is the most money they will lend you. Then, when you shop, you can use the credit card to buy things.

A number of its benefits may be hard to use based on your business needs, especially if you can’t shift your spending habits to adapt to the perks. These valuable categories can add up to a big rewards payday if your business has an office. We are an independent, advertising-supported comparison service. At the branch level and in customer service offices, there are also roles for supervisors. Managers must be able to show that they are good at building teams, giving good customer service, and selling.

Bank of America Career Opportunities

If you get unemployment benefits from the state of California, Bank of America may be able to give you an EDD debit card. Here’s what you need to know about life insurance from Bank of America. Even though you can’t buy a new life insurance policy from Bank of America, many people still have life insurance policies with the company. People are often surprised to find out that Bank of America used to sell life insurance and insurance for accidental deaths. Equipment loans are made to help you buy expensive equipment that your business needs to run. This loan can help you get your business going, whether you need packing machines, conveyor belts, printing presses, or a delivery truck.

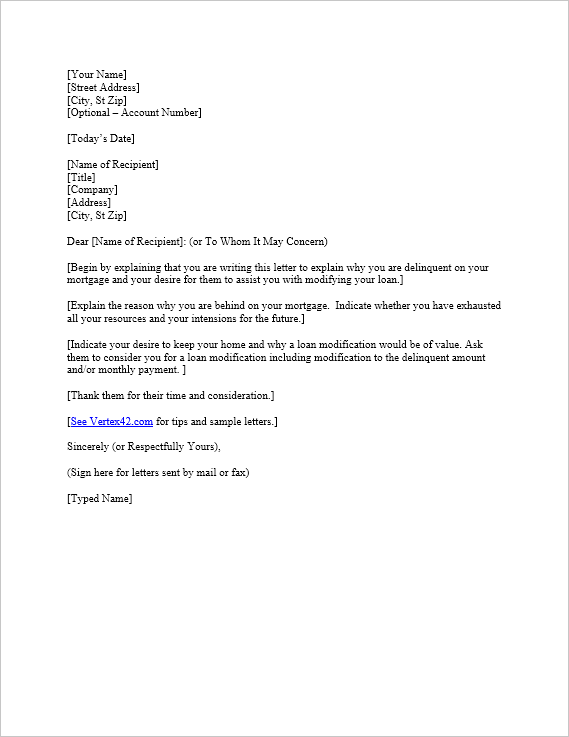

A loan modification changes the terms of your loan in order to try to achieve more affordable payments. The Variable Intro Rate is based upon The Wall Street Journal Prime Rate (“Prime”) minus a discount; the results in the APR state above, and can change periodically based on Prime. No customer or other discounts are available during the Variable-Rate Introductory Period.

Home Equity Loans

Manage your account, make payments and transfer funds using our top-rated Mobile Banking app and Online Banking. If you were denied home loan assistance, such as a request for a loan modification, short sale or deed in lieu, you may be able to dispute the decision. With the Home Loan Navigator, you know where your loan stands every step of the way. If you're thinking about buying a home, our expert lending specialists can connect you to affordable housing assistance programs. When combined with an eligible loan, these assistance programs can help qualified homebuyers achieve successful homeownership.

Provides a flexible spending limit for extensive purchasing power, plus the ability to carry a balance in a pinch with Pay Over Time plans. Big spenders may find their rewards hobbled by the 5 percent categories’ $25,000 yearly spending limit and the 2 percent categories’ equal $25,000 yearly limit . Meet you wherever you are in your credit card journey to guide your information search and help you understand your options. Standard Term CDs require a minimum deposit of $1,000 and pay an annual percentage yield of 0.03% on all balances and terms. The requirements for qualification are the same as those for a business credit line.

At Bills.com, we strive to help you make financial decisions with confidence. While many of the products reviewed are from our Service Providers, including those with which we are affiliated and those that compensate us, our evaluations are never influenced by them. For more information regarding Bills.com’s relationship with advertised service providers see our Advertiser Disclosures.

Once a HELOC offer is made to the borrower, they can decide whether to accept the terms or cancel the application. Remember that applying for a Bank of America HELOC does trigger a hard credit check, affecting credit scores. It may be helpful to use Bank of America's home equity line of credit calculator before applying to determine if pursuing a HELOC with the bank makes sense. This might be worth doing because the Bank of America's HELOCs does not have any closing costs or conversion fees. It might be because HELOCs often have lower fees than home equity loans.

We pulled expert and consumer ratings online to determine how good Bank of America home equity loans are and combined them to arrive at our star ratings. Overall, Bank of America scores a 3-star rating on average, based on our findings. The bank received the lowest ratings overall at Trustpilot and the Better Business Bureau based on consumer ratings and reports. Bank of America also requires the year the property was purchased, the purchase price, and whether there is a loan currently in place. The bank collects demographic information, including asking questions about race and sex, but borrowers have the option not to answer.

A business term loan gives you a lump sum of cash that you can pay back over the next one to five years. You can go to your lender and ask for money from your HELOC. ARMs are better than fixed-rate mortgages because the initial rate is usually much lower.

No comments:

Post a Comment